contra expense account definition and meaning

Any products that are sold at a discount or returns are deducted from gross revenue to produce net revenue as the top line on the income statement. An example of a contra liability account is the bond discount account, which offsets the bond payable account. A contra liability account is not classified as a liability, since it does not represent a future obligation. The following are examples of contra expense accounts used in double entry bookkeeping. The contra asset account Accumulated Depreciation is deducted from the related Capital Assets to present the net balance on the parent account in a company’s balance sheet. Whereas assets normally have positive debit balances, contra assets, though still reported along with other assets, have an opposite type of natural balance.

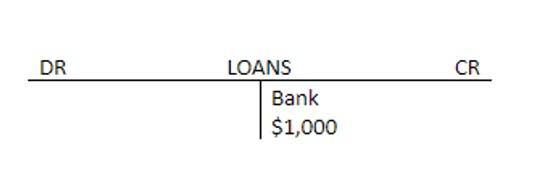

Example of a contra account

For instance, the company might debit its expense account 4210 Employee Health Insurance Expense when recording the insurance company’s invoice of $10,000. If the company withholds $2,000 from its employees’ wages to pay part of the https://www.bookstime.com/ cost of the insurance, the company will credit its contra expense account 4211 Employee Withholdings for Health Ins. A contra expense account is a general ledger expense account that will intentionally have a credit balance (instead of the debit balance that is typical for an expense account). In other words, this account’s credit balance is contrary to (or opposite of) the usual debit balance for an expense account. Contra expense accounts have a natural credit balance, as opposed to the natural debit balance of a typical expense account. Therefore, a contra expense account that contains a debit balance must have a negative ending balance.

- Another description of a contra expense account is an account that reduces or offsets the amounts reported in another general ledger expense account(s).

- Any products that are sold at a discount or returns are deducted from gross revenue to produce net revenue as the top line on the income statement.

- When the two balances are offset against each other they show the net balance of both accounts.

- Contra assets give investors a better picture of how you use your assets over time.

- The contra asset account Accumulated Depreciation is deducted from the related Capital Assets to present the net balance on the parent account in a company’s balance sheet.

Bookkeeping

Contra asset accounts are recorded with a credit balance that decreases the balance of an asset. A key example of contra liabilities includes discounts on notes or bonds payable. Purchase returns, allowances and discounts are all examples of contra expense accounts. The accounts normally have a credit balance and contra expenses in use are offset against the purchases account which is normally a debit balance.

What is a Contra Expense Account?

- The dollar balance in the allowance for uncollectible accounts is the amount you don’t expect to collect, and this offsets the amount you report in accounts receivable.

- For instance, if a company receives a rebate on a previously recorded expense, the rebate would be recorded in a contra expense account, effectively reducing the total expense reported.

- These accounts facilitate auditing and financial analysis by providing a detailed breakdown of adjustments made during a specific accounting period.

- When an expense is initially recorded, it is debited to the relevant expense account.

- Contra Equity Account – A contra equity account has a debit balance and decreases a standard equity account.

A contra account is an account with a balance opposite the normal accounts in its category. Contra accounts are usually linked to specific accounts on the balance sheet and are reported as subtractions from these accounts. In other words, contra accounts are used to reduce normal accounts on the balance sheet.

Simply hit Control + N under the Chart of Accounts or Edit, then click New (to create a new account). A contra account is a general ledger account that offsets the balance of a corresponding account with which it’s paired. If you debit the contra account, ensure that you offset the related account with a credit balance. In essence, contra accounts allow you to report your firm’s gross and net amounts. https://x.com/BooksTimeInc These accounts also ensure that you follow the matching principle in accounting, which states that you record expenses in the same period you incur them. The contra revenue account is a reduction from gross revenue, which results in net revenue.

Impact on Financial Statements

By keeping the original dollar amount intact in the original account and reducing the figure in a separate account, the financial information is more transparent for financial reporting purposes. For example, if a piece of heavy machinery is purchased for $10,000, that $10,000 figure is maintained on the general ledger even as the asset’s depreciation is recorded separately. Contra expense accounts are indispensable tools in financial analysis, offering a nuanced lens through which analysts can assess a company’s cost management strategies.

- Given that liabilities have a credit balance, ensure that all your contra liabilities accounts have debit balances.

- Instead, it is reported at its full amount with an allowance for bad debts listed below it.

- They ensure that financial statements adhere to standardized accounting practices, enhancing the credibility and comparability of financial reports.

- A contra liability account is not classified as a liability, since it does not represent a future obligation.

- A debit will be made to the bad debt expense for $4,000 to balance the journal entry.

- Therefore, a contra expense account that contains a debit balance must have a negative ending balance.

A contra account is an essential concept in financial accounting that serves to offset the balance of another account. It plays a vital role in maintaining the accuracy and transparency of a company’s financial statements. Contra accounts are used to record adjustments, reversals, or reductions in the value of assets or liabilities.

- Conversely, consistent discounts received could indicate strong supplier relationships and effective negotiation tactics.

- An asset that is recorded as a credit balance is used to decrease the balance of an asset.

- Treasury stock and owner’s drawing account are examples of contra equity accounts.

- When researching companies, the financial statement is a great place to start.

- The balance in the allowance for doubtful accounts represents the dollar amount of the current accounts receivable balance that is expected to be uncollectible.

- These insights allow analysts to make more informed recommendations for operational improvements and strategic planning.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Contra liabilities

The reason you show a contra asset on a balance sheet is so you can see the overall net balance of a particular asset and to give investors a more accurate look into your company’s financial activity. A bank-to-bank transfer involves journal entries that debit the bank account from which funds are transferred and credit the receiving bank account. To record these transactions, GadgetHub will create a contra expense account called “Purchase Discounts.

Examples of Contra Accounts

Within equity, an example of a contra account is the treasury stock account; it is a deduction from equity, because it represents the amount paid by a corporation to buy back its stock. The allowance method of accounting allows a company to estimate what amount is reasonable to book into the contra account. The percentage of sales method assumes that the company cannot collect payment for a fixed percentage of goods or services that it has sold. When accounting for assets, the difference between the asset’s account balance and the contra account balance is referred to as the book value. There are two major methods of determining what should be booked into a contra account.