Cellular Deposit Remote Deposit Deposit from the Cell phone

If the reasoning is that their system user try experience brief billing outage you can try to really make the purchase once again, and you may something should go thanks to without any problem anyway. Same web page hook up output in order to footnote visit the website resource 3Chase Cellular software can be acquired to have come across mobiles. Gesa Borrowing from the bank Connection then sends the brand new fee into the Gesa Borrowing from the bank Union membership, the while keeping the painful and sensitive account info private. As well as having a limit to your limit places, your obtained’t manage to cash-out by using the pay by the cellular phone strategy.

Visit the website – How come We not understand the Deposit Checks alternative to my Apple equipment?

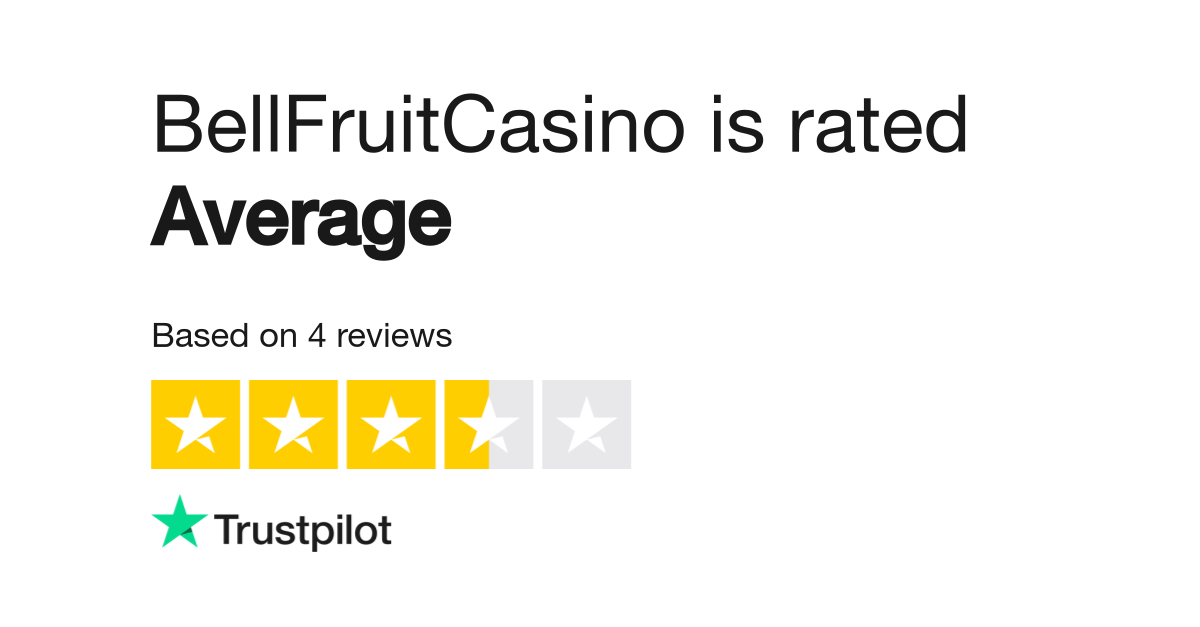

Zero, not all online casinos encourage the fresh Shell out by the Cellular telephone approach, that it’s crucial that you check around before signing up. In order to locate fairly easily a knowledgeable information, check out the of these We’ve listed on this page – i continuously modify him or her. Sure, it’s safer to invest with your cellular, delivering that you’re to play at the an authorized and you may controlled on line gambling enterprise. Our required Shell out By the Cell phone gambling enterprises utilize the current SSL security application and you can authentication features, so that you provides complete reassurance. Your selection of gambling games ‘s the anchor of all on the internet gambling enterprises. I’yards speaking of not just the kinds of games which might be readily available but furthermore the amount of online game.

Do not faith a keen unlicensed site, therefore the the initial thing i perform when vetting a wages because of the cell phone statement gambling enterprise is always to check that it’s passed by recognized gambling bodies. Keep an eye out to have reputable licenses including the MGA, UKGC and Curaçao eGaming. I in addition to make sure that the website features an encoded SSL connection, and that handles people personal statistics you publish on the gambling enterprise.

Paypal Charge: What you need to Know

If that’s the case, visiting a lender department otherwise Atm in order to put them you will not an issue. Chase QuickDeposit enables you to deposit inspections from cellular software. To make use of this service membership, you must earliest download the new application on the smartphone or pill. Immediately after one’s complete, pursue such actions in order to put a check playing with Pursue QuickDeposit. You’ve got every piece of information you should begin playing during the web based casinos thru pay by cell phone bill.

As well, your emailed-then-published duplicate may also probably face increased scrutiny. It’s completely within the discretion of the lender to simply accept it or perhaps not. Excite disable their adblocker to enjoy the perfect internet feel and you can access the high quality content your delight in out of GOBankingRates. You.S. Trust Business of Delaware try a completely had part from Bank of America Business. “Be the extremely preferred and you can leading standard bank serving the brand new army in addition to their family.” Hold your tool regular, myself along the view, as well as the photographs would be removed instantly.

Yet not, the wireless provider you’ll fees messaging otherwise research charge. Deposits generated to the a federal getaway have a tendency to hit your bank account on the the initial go out pursuing the second working day. If the escape drops to the a saturday, such, your bank account might possibly be on Wednesday. When the, for example, you exposed your account regarding the Eastern time area therefore deposit a just before 9 p.m. Once you name, be prepared to deliver the appropriate account number, studio, inmate, and you may fee advice. To make a rely on Money and you may/otherwise PIN Debit deposit, you are expected to supply the facility’s “Web site ID” (and therefore, when needed, is available to your studio’s webpage).

It could be due to a mistake on your lead to transferring the brand new cheque. In that case, you’d need to twice-look at your signature and approval, extent you entered on the put as well as the top-notch their cheque photos. Bringing a cellular cheque put to go through is generally because the simple as snapping another image of the front and you may straight back of your cheque and resubmitting they. If you are here’s a great deal to including in the mobile cheque put, there are many potential disadvantages.

- You can seamlessly financing their gambling efforts by the hooking up your own Neteller account that have Boku.

- It’s completely inside the discernment of the bank to accept they or otherwise not.

- Pursue Earliest Financial profile must be associated with a great qualifying Pursue bank account.

- Although not, the brand new Spend by the Mobile fee approach isn’t valid because of their 100 100 percent free revolves welcome render.

You are Today Leaving United BANK’S Webpages

Put inspections out of nearly everywhere for the Financial of The united states Mobile Financial appadatext on your own smartphone otherwise tabletadatext. Discover a confirmation which means you know instantly your own deposit have become received. Just after entry the fresh consider visualize and you may guaranteeing their receipt of your finance, safely shop your own look for thirty day period.

Just how cellular deposit works

Cancellation.We could possibly terminate otherwise suspend the service, or the utilization of the Provider, when. You can also terminate their utilization of the Services any moment by providing notice to help you united states. Your observe will never be energetic until i discover their observe away from cancellation and now we had a reasonable time to behave about it. Notwithstanding cancellation, people Image sent from Service is going to be susceptible to that it Agreement. “Business day” form Tuesday as a result of Monday and specifically excludes any getaway on which either the financial institution otherwise Merrill is not unlock to own organization. Definitions”You” and you may “your” setting men otherwise home business entity (or its registered member, since the applicable) that has subscribed to the service.

Deposit charges

Get on the new Ally Mobile Application, favor your bank account and tap “Put Inspections”. Take the photos of the sign in a well-lit area and put they to the a dark, non-reflective record. Be sure there aren’t any shadows, and be sure you will see all the sides of your take a look at along with clearly check out the navigation and account numbers. Extremely profiles would be to discover Lender from The usa cellular deposit to help you end up being a valuable equipment.

Select organization checking, small business money, organization playing cards, supplier characteristics or see all of our team funding center. If your latest membership doesn’t provide this particular aspect, it could be well worth evaluating checking accounts to get one that comes with mobile take a look at put or any other beneficial electronic financial have. You could inquire who is able to gain access to the brand new painful and sensitive suggestions displayed to the a, however, take a look at photos aren’t held on the cellular phone. Depending on the financial, money transferred through cellular take a look at deposit is generally readily available as soon since the next day. Banking institutions provides financing accessibility regulations one decide how a lot of time it needs to own a to clear.

Simultaneously, mobile places to help you FDIC-insured account is actually safe like any other put. It’s easier than in the past and make an instant look at put to help you your account. All of our Mobile Put element allows you to safely deposit inspections in this the Financial Which have Joined cellular application.

Tips Endorse a Cheque for Mobile Deposit

Ensure that the whole cheque is seen inside the corners of the brand new body type. Keep the tool constant and the app tend to automatically bring a great photos of the cheque. The fresh edges of one’s physique will be different in order to eco-friendly if image has been removed. Go into the amount and you can a guide if you’d like one to, then discover ‘Bring photographs’.